Market Overview:

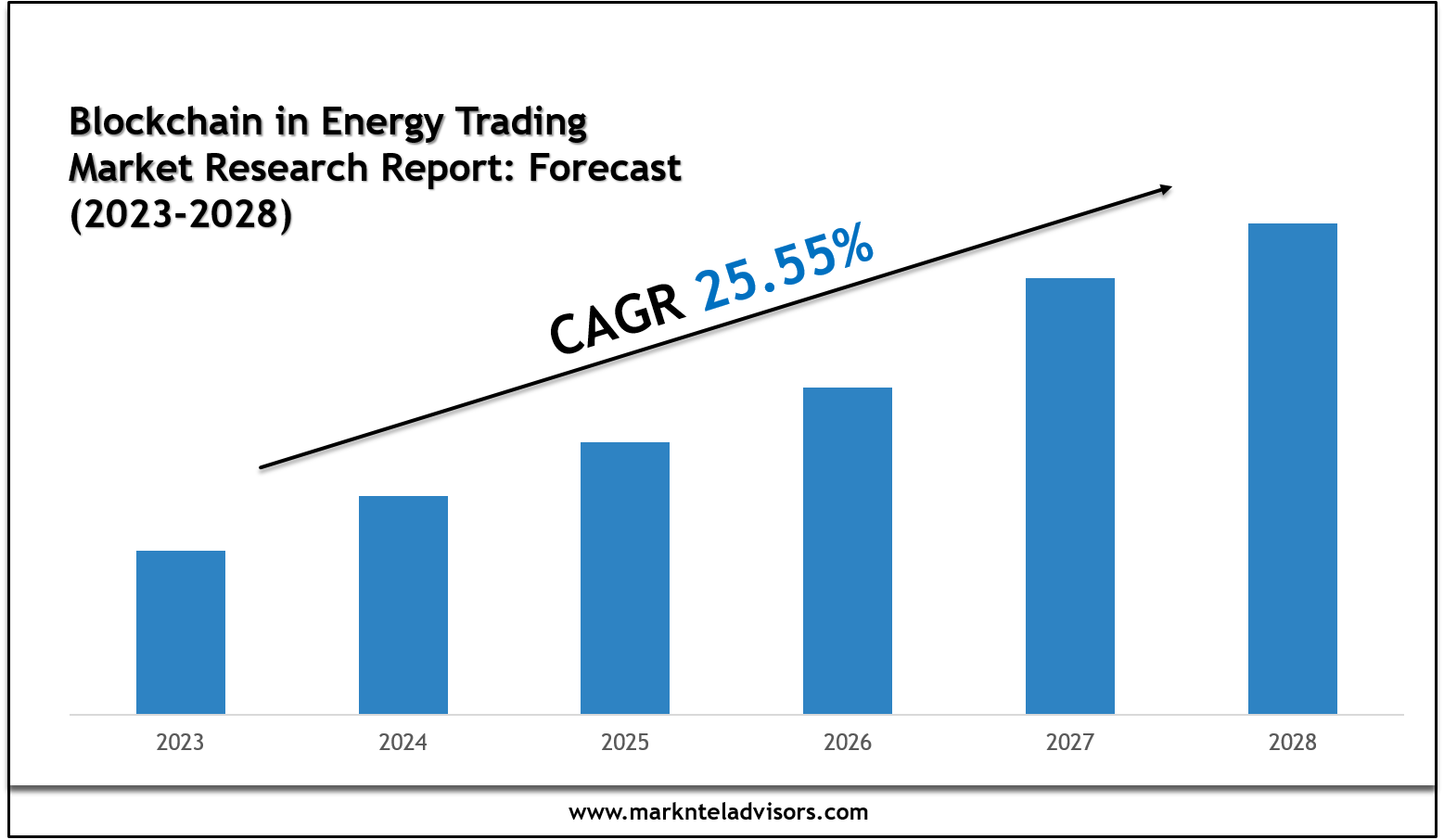

This report presents an extensive evaluation of the Blockchain in Energy Trading Market, focusing on historical data from 2019 to 2022 while offering detailed forecasts for the period between 2023 to 2028. The analysis encompasses various aspects, including market Size, Share, Growth, Analysis, Trends and competitive insights.

In case you missed it, we are currently revising our reports. Click on the below to get the latest research data with forecast for years 2023 to 2028, including market size, industry trends, and competitive analysis. It wouldn’t take long for the team to deliver the most recent version of the report.

Get Free Sample Copy of the Report - https://www.marknteladvisors.com/query/request-sample/blockchain-in-energy-trading-market.html

Table of Contents (Blockchain in Energy Trading Market)

- Executive Summary

- Market Definition & Research Methodology

- Market Dynamics: Drivers, Challenge, Trend and Opportunities

- Segment Analysis and Geographical Breakdown

- Competitive Landscape & Strategic Initiatives

- Regulatory Environment & Policy Factors

- Growth Forecast Model (2023–2028)

- Appendix: Company Profiles, Data Sources, Methodology

What’s covered in the report?

Market Key Driver:

Rapid Growth of Renewable Energy Sources to Escalate the Market – The surging growth of renewable sources across the globe is accelerating the Energy Trading Market. Renewable energy sources, such as solar & wind power, are becoming more affordable & reliable owing to increasing government policies & incentives, technological advancement, financial investment from private & institutional investors, etc. According to the IRENA, in 2022, costs for renewables continued to fall in 2021, electricity from wind fell by around 15%, offshore wind by about 13%, and solar photovoltaics (PV) by 13% compared to 2020. As solar & wind become more prevalent, households & businesses are increasingly becoming prosumers, generating their electricity & sometimes producing excess energy that could be shared with others.

Consequently, blockchain technology could facilitate this energy exchange through decentralized & transparent peer-to-peer (P2P) transactions, creating Local Energy Markets. By enabling real-time matching of energy supply & demand blockchain, energy trading optimizes grid stability & fosters a more resilient & decentralized energy ecosystem.

Smart contracts on the blockchain ensure fair compensation for prosumers & streamline energy transactions without intermediaries. As renewable energy continues to grow, the blockchain energy trading market is poised to expand, bringing about a more sustainable & efficient energy future.

Full Report Summery [TOC + Content] - https://www.marknteladvisors.com/research-library/blockchain-in-energy-trading-market.html

Leading players of Blockchain in Energy Trading Market including:

- Power Ledger

- SunContract

- Wepower

- Restart Energy

- Electron

- Mission Innovation

- Blockchain Tech LTD

- Enosi

- Grid Singularity

- LO3 Energy

- Others

Blockchain in Energy Trading Market Segmentation:

By Type

- Public

- Private

By Application

- Peer to Peer Energy Trading

- Regulation and Compliance Management

- Commodity Trading

- Electricity Data Management

- Grid Management

Peer-to-Peer Energy (P2P) trading is gaining notable momentum across developed economies due to the ability of consumers to buy & sell excess energy within their community.

By End User

- Power Utilities

- Oil and Gas

- Residential Communities

- Commercial & Industrial

By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia Pacific

Among the regions globally, Europe is emerging as a significant center for blockchain-based energy trading due to the increasing adoption of advanced technology in various industries and the support from national governments in the region.

Fill the Form For Customized Report Enquiry - https://www.marknteladvisors.com/query/request-customization/blockchain-in-energy-trading-market.html

Key Highlights of MarkNtel Advisors' Research Methodology

- MarkNtel Advisors uses a robust methodology for accurate market analysis.

- Research objectives are clearly defined with tailored methodologies for clients.

- A representative sample is selected to ensure reliable data collection.

- Data analysis includes cleaning, statistical evaluations, and validation checks.

- Predictive modeling forecasts trends, and reports include strategic recommendations.

About MarkNtel Advisors:

We are a leading market research firm providing research, consulting, and data-driven intelligence to clients across diverse industries globally. Our reports are tailored to help businesses identify lucrative opportunities and mitigate potential risks using actionable insights.

Others Report –

https://www.marknteladvisors.com/research-library/adult-entertainment-market.html

https://www.marknteladvisors.com/research-library/adult-entertainment-market.html

Contact Us:

MarkNtel Advisors LLP

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India

For Sales Enquiries: [email protected]