Overview of the Australia Carbon Credit Industry:

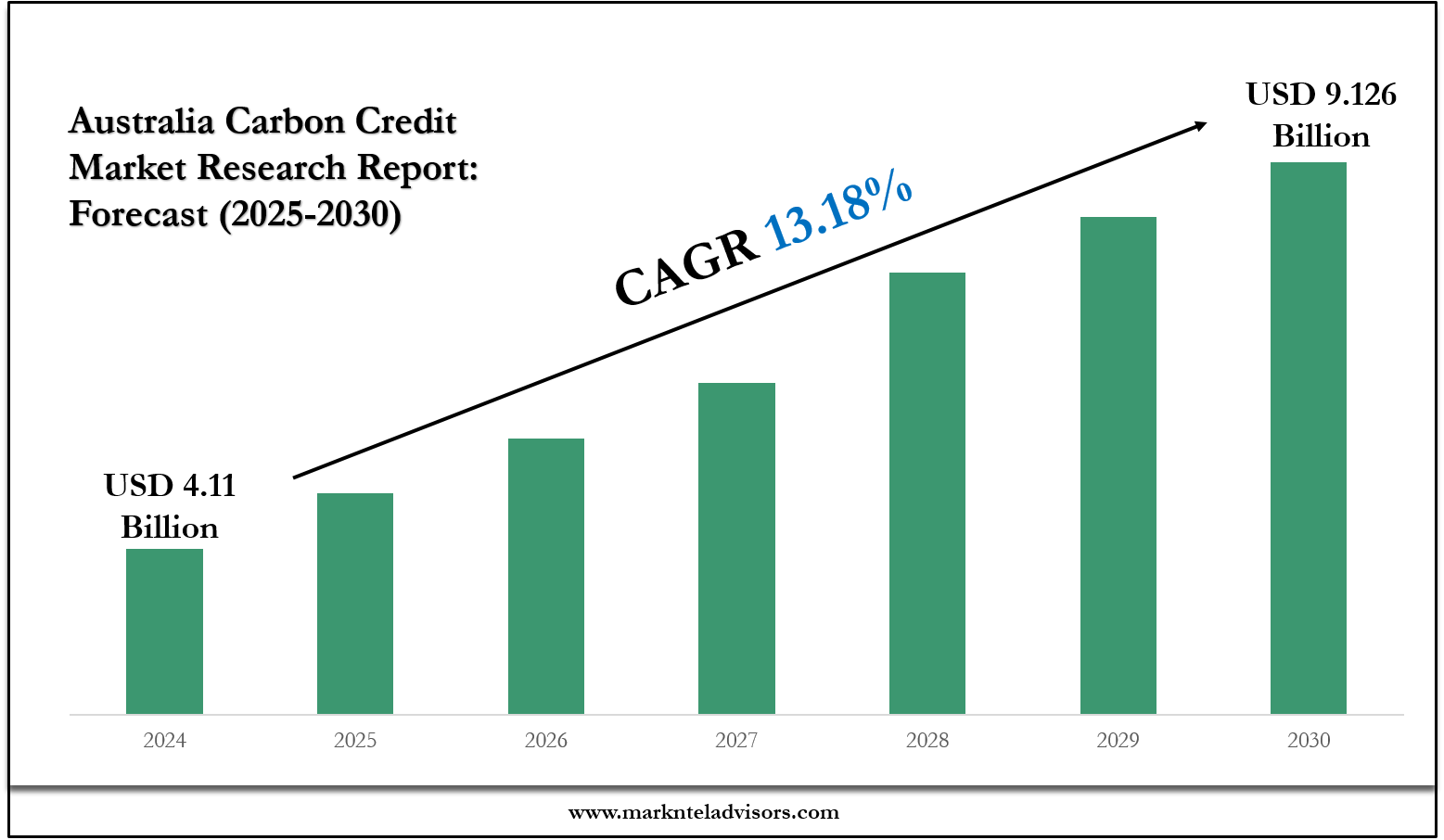

The Australia Carbon Credit Market is projected to experience substantial growth between 2025 and 2030, driven by digital transformation, innovation in service delivery, and expanding demand. The Australia Carbon Credit Market size was valued at around USD 4.11 billion in 2024 and is projected to reach around USD 9.126 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 13.18% during the forecast period, i.e., 2025-30. This report offers an in-depth analysis of the key drivers, challenges, competitive landscape, and future outlook — helping businesses, investors, and stakeholders make informed decisions.

Market Size & Forecast (2025–2030)

- Base Year: 2024

- Forecast Period: 2025–2030

- CAGR (2025-30): 13.18%

Australia Carbon Credit Market Trend:

Integration of Blockchain Technology in Carbon Credit – The incorporation of blockchain technology is transforming the market by facilitating the monitoring, verification, and trading of carbon credits. It is increasing market participant’s trust, security, and transparency. Initially, the carbon credit trades were facilitated through brokers or exchanges handled without documentation and verification procedures. Blockchain works as a decentralized ledger to guarantee that each carbon credit has a distinct identity thereby avoiding problems like fraud and double counting. Transaction integrity is protected by its cryptographic security and credit issuance is accelerated by smart contracts. Increased confidence among buyer sellers and regulators is a result of this transparency which promotes increased market participation.

Further simplifying the trading process, blockchain and artificial intelligence can be used to find possible carbon offset projects and optimize pricing strategies. All things considered, this technological integration not only resolves current issues but also creates new opportunities for a variety of stakeholders making the carbon market more dependable and efficient as the sector strives to meet Australian climate goals.

Get Sample Report - https://www.marknteladvisors.com/query/request-sample/australia-carbon-credit-market.html

Top Companies in the Australia Carbon Credit Market

Here’s a snapshot of key players leading innovation and market share:

- AgriProve

- Cool Planet

- Carbon place

- Carbonex

- Carbonex

- Carbon Trade Exchange

- Xpansiv

- Climate Active

- Land Life

- Others

Includes SWOT analysis, revenue trends, partnerships, and product launches.

Explore Our Comprehensive Study: https://www.marknteladvisors.com/research-library/australia-carbon-credit-market.html

Australia Carbon Credit Market Segmentation Analysis

-By End User

- EnergY

- Manufacturing and Heavy Industry

- Transportation

- Forestry and Agriculture

- Others

The electronics type products hold the largest share of more than 15% in the Australia Carbon Credit Market.

-By Type

- Voluntary

- Compliance Based

The compliance-based segment holds approximately 60% of the market share and is also anticipated to grow in the forecasted period.

-By Enterprise

- Large Enterprise- Market Size & Analysis by Revenues- USD Million

- Medium & Small Enterprise - Market Size & Analysis by Revenues- USD Million

Requests Customization: https://www.marknteladvisors.com/query/request-customization/australia-carbon-credit-market.html

Geographical Analysis

-By Region

- North

- South

- East

- West

Methodology Behind the Report

This research combines qualitative and quantitative methods, including:

- Expert interviews

- Proprietary forecasting models

- Financial and trade databases

- Government and institutional data

Forecasts are validated using top-down and bottom-up approaches to ensure accuracy and reliability.

Frequently Asked Questions About the Australia Carbon Credit Market

- What is the growth rate of the Australia Carbon Credit market from 2025–2030?

- Which segment are expected to dominate market?

- Who are the top companies and what strategies being they using?

- What are the key risks and challenges in this industry?

- How can businesses prepare for future trends?

About Us –

MarkNtel Advisors is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

We have our existence across the market for many years and have conducted multi-industry research across 80+ countries, spreading our reach across numerous regions like America, Asia-Pacific, Europe, the Middle East & Africa, etc., and many countries across the regional scale, namely, the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and several others.

Media Contact:

Company Name: MarkNtel Advisors

Email: [email protected]

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh - 201301, India