The global Electrical Tapes Market Size is charting a steady growth trajectory as demand surges across electrical insulation, automotive wiring, industrial applications, and infrastructure development. Electrical tapes—ranging from PVC-based tapes to specialized high-performance adhesive films—are central to ensuring safety, performance and durability in electrical systems. With the rise of electrification, smart manufacturing, automotive wiring complexity, renewable energy installations and construction activities, these materials are becoming indispensable in modern applications.

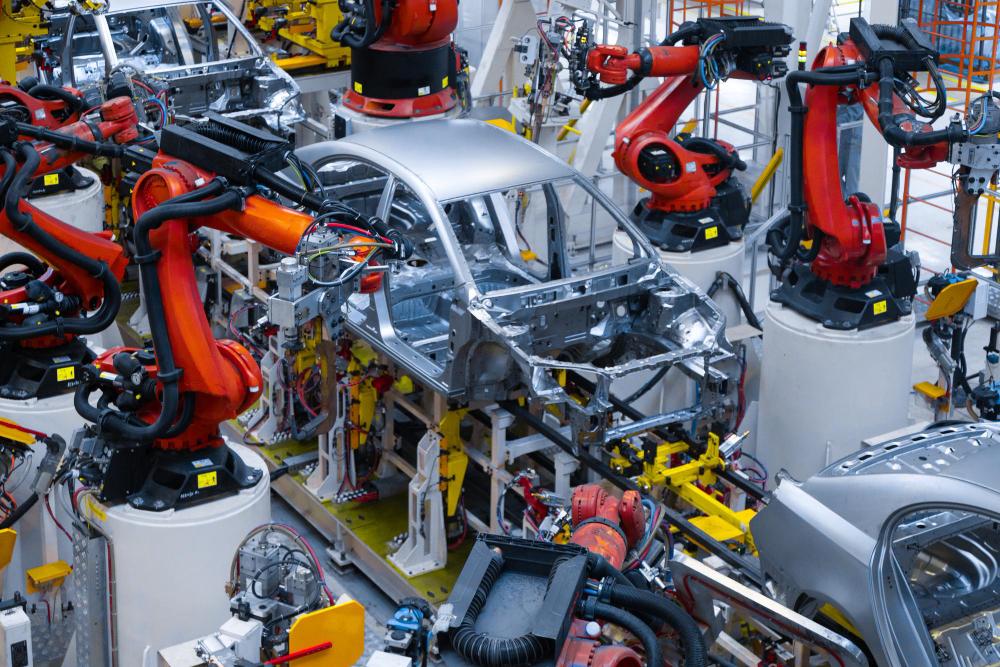

One of the key drivers of this market is the pervasive expansion of electrification and wiring complexity across industries. As more electrical devices, grid upgrades, EV charging stations and wiring installations are deployed, the need for reliable insulation, bundling, protection and masking solutions increases. Electrical tapes are essential in scenarios where wires must be bundled, protected from abrasion, sealed from moisture and insulated from short-circuit risk. The automotive sector in particular contributes heavily: the shift to electric vehicles, complex wiring harnesses, battery modules and high-voltage systems demands advanced tape solutions that accommodate higher temperatures, chemical resistance and mechanical durability. Another driver is infrastructure growth and construction: new buildings, retrofit projects, smart-grid upgrades and renewable energy systems all require high-quality electrical insulation materials and protective tapes, enabling greater adoption of electrical tapes across regional markets. Additionally, regulation and safety standards are emphasising better insulation, fire performance, durability and traceability which pushes manufacturers to adopt higher-spec tapes rather than generic adhesives.

Technological advancement in the electrical tapes market is evolving in both materials and application domains. Tape manufacturers are innovating with new backing materials such as polyester films, glass cloth, polyimide and high-temperature resistant substrates that meet tougher thermal and mechanical requirements. Adhesive technologies are also advancing, offering improved tack, adhesion on difficult surfaces (plastics, composites, painted metals), and long-term durability under vibration or temperature cycling. Color-coded tapes help with circuit identification and safety compliance; eco-friendly and halogen-free tapes cater to sustainability regulations. Smart tape variants incorporating arc-flash protection, enhanced flame-retardancy and UV-resistance are gaining traction, especially for high-voltage and outdoor applications. In the automotive and mobility domain, tapes are being specified for wiring harnesses, battery module insulation, thermal shielding and vibration damping—where space is constrained and performance demands are rising. These innovations enhance the value proposition of electrical tapes and expand their applicability across newer end-uses.

On a regional basis the market patterns for electrical tapes reveal interesting dynamics. Asia-Pacific is often the fastest-growing region due to rapid industrialisation, strong electronics manufacturing, increasing vehicle production, and infrastructure investment in countries such as China, India and Southeast Asia. Local manufacturing hubs for components and wiring harnesses feed demand for insulation tapes. North America holds a mature market characterised by high safety and performance standards, automotive and aerospace demand, and replacement/aftermarket segments. Europe features strong demand for specialised high-performance tapes tied to automotive, electronics and industrial sectors and more stringent regulations around insulation and fire safety. Emerging regions such as Latin America, the Middle East and Africa present potential growth opportunities — as infrastructure builds out, vehicle electrification expands and electronics consumption rises — though they often face cost-sensitivity, supply-chain constraints and slower replacement cycles compared to mature markets.

In conclusion the electrical tapes market size is set to expand steadily as the interplay of electrification, wiring complexity, automotive mobility trends, infrastructure development and technology advancement drives demand. The key opportunities lie not only in volume growth but in upgrading tape performance, expanding into new materials, and serving emerging end-uses beyond traditional wiring applications. Stakeholders who align with these trends—innovating in materials, adhesives and application integration, as well as positioning regionally—stand to capture meaningful value in this evolving market.

FAQs

Q1: What is driving the expansion of the electrical tapes market size?

The expansion is driven by increasing electrification across industries, higher wiring complexity in vehicles and electronics, infrastructure and construction growth, regulatory demands for better insulation and protective materials, and the rising adoption of electric vehicle systems.

Q2: What technological developments are influencing the electrical tapes market?

Technological developments include advanced backing materials (glass cloth, polyimide, polyester films), improved adhesives for durability and harsh environments, colour-coded tapes for identification and safety, eco-friendly halogen-free materials, and application-specific solutions for automotive, battery systems and high-voltage wiring.

Q3: Which regions present the greatest growth opportunities for electrical tapes?

Asia-Pacific offers the greatest growth potential due to industrialisation, electronics manufacturing and vehicle production; North America and Europe remain strong in premium/high-performance segments tied to automotive and industrial end-uses; emerging markets hold long-term upside as infrastructure, wiring installations and electrification accelerate.

More Related Report

Vehicle Electrification Market Share