Global Rolling Stock Market Outlook (2024–2032)

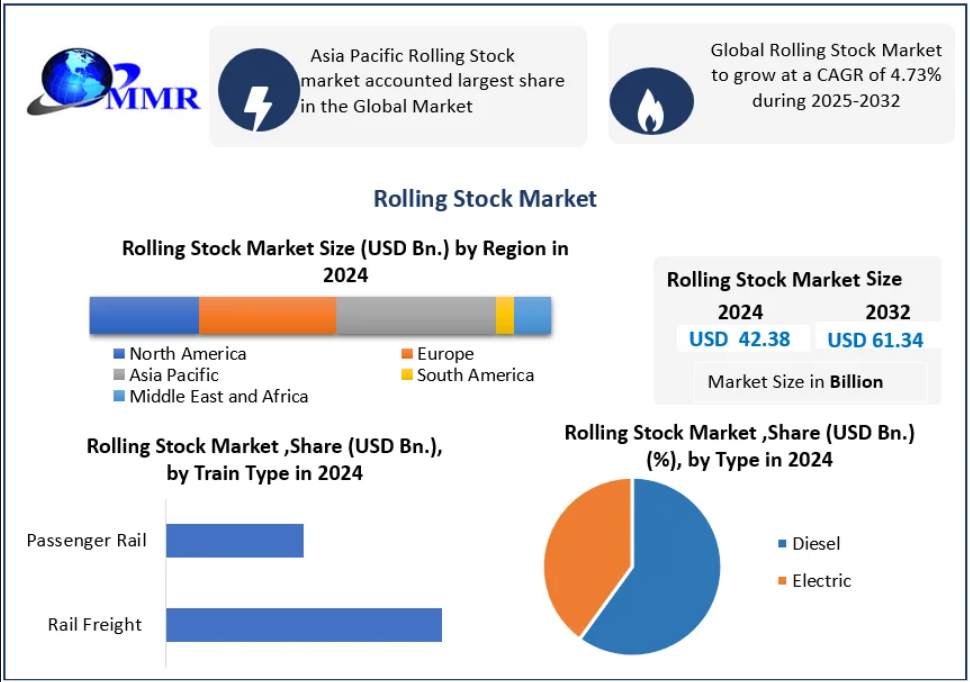

The Global Rolling Stock Market, valued at USD 42.38 billion in 2024, is set for steady expansion and is projected to reach USD 61.34 billion by 2032, growing at a CAGR of 4.73%. Rolling stock—which includes locomotives, passenger coaches, freight wagons, and rapid transit vehicles—remains central to modern rail transport systems worldwide.

With countries prioritizing rail modernization, sustainable mobility, and high-speed connectivity, the market is entering a transformative era driven by electrification, digitalization, and autonomous technologies.

Market Overview

The rolling stock industry is experiencing a major transition, supported by:

- Rising urbanization and the expansion of metro networks

- Government-led rail infrastructure spending

- Demand for energy-efficient trains

- Shift toward sustainable and autonomous mobility

Asia Pacific leads the global market thanks to rapid metro expansion in China and India, while Europe and North America remain focused on upgrading legacy systems and transitioning to cleaner propulsion technologies.

Key industry leaders—CRRC, Alstom, Siemens Mobility, and Wabtec—are advancing next-generation platforms including hydrogen trains, battery-electric locomotives, and AI-enabled predictive maintenance systems.

Click here to claim your free sample report and uncover the most lucrative market segments: https://www.maximizemarketresearch.com/request-sample/26747/

Market Dynamics

🔋 1. Electrification & Automation Transforming Rolling Stock

Rail networks worldwide are embracing zero-emission propulsion:

- Hydrogen trains such as Alstom’s Coradia iLint are redefining clean mobility.

- Battery-powered regional trains, like Siemens’ Mireo Plus B, are gaining commercial traction.

- Autonomous metros built by CRRC and Hitachi signal the future of driverless transit.

With the EU phasing out new diesel trains by 2035, electrification investments are expected to rise at 8% CAGR through 2025, accelerating replacement cycles for older rolling stock.

🚄 2. Urbanization & High-Speed Rail Growth

High-speed rail (HSR) and metro development remain primary demand drivers:

- China plans to double its HSR network by 2035.

- India boosts demand with the Vande Bharat Express program, dedicated freight corridors, and metro rail expansion.

- Europe is investing >€7 billion in fleet modernization, while the U.S. accelerates Amtrak and California HSR upgrades.

Passenger transit demand is surging as cities prioritize congestion reduction and sustainable urban mobility.

Segment Analysis

By Type

Diesel Rolling Stock – Dominant in 2024

Diesel locomotives continue to lead due to:

- High torque for heavy haul freight

- Lower upfront cost compared to electric alternatives

- Ability to operate in non-electrified regions

North America, mining operations, and bulk cargo industries heavily rely on diesel fleets.

Electric Rolling Stock – Fastest Growing

Electric trains are expanding quickly in:

- Passenger rail

- Urban transit

- High-speed corridors

Government incentives, lower operating costs, and sustainability goals are accelerating adoption.

By Train Type

Rail Freight – Largest Market Share

Freight dominates due to:

- Its vital role in long-distance bulk cargo transport

- Heavy industry reliance (mining, agriculture, manufacturing)

- Cost-efficiency and payload capacity

Emerging innovations include hybrid freight locomotives and hydrogen fuel cell-powered cargo trains.

Passenger Rail – Rapid Growth Segment

Driven by:

- Urban rail network expansion

- Rising HSR projects

- Eco-friendly public transportation demand

- Smart city initiatives

Metro systems and EMUs (Electric Multiple Units) are growing aggressively worldwide.

Click here to claim your free sample report and uncover the most lucrative market segments: https://www.maximizemarketresearch.com/request-sample/26747/

Regional Analysis

🌏 Asia Pacific – Market Leader

The region commands the largest share due to:

- Huge investments in metro rail and HSR

- Rapid urbanization in China, India, and Southeast Asia

- Adoption of electric and autonomous rail technologies

China’s CRRC continues to dominate global exports.

🌍 Middle East & Africa – Fastest Growing

Growth driven by:

- Increasing freight movement for mining and oil & gas

- Development of national rail strategies (UAE, Saudi Arabia, Egypt)

- High-demand corridors for cargo and passenger connectivity

🌎 North America & Europe

- Europe focuses on fleet modernization, hydrogen trains, and sustainability mandates.

- North America remains freight-centric, with Wabtec leading hybrid locomotive development.

Competitive Landscape

The market is characterized by strong global and regional competition:

Key Players

- CRRC (China) – World’s largest rolling stock manufacturer

- Alstom (France) – Leader in hydrogen train technology

- Siemens Mobility (Germany) – Pioneer in digital rail & battery-electric trains

- Wabtec (USA) – Dominates freight rail & battery-hybrid locomotives

Other Notable Companies

- Hitachi Rail (Japan/UK)

- Stadler Rail (Switzerland)

- Hyundai Rotem (South Korea)

- Kawasaki Heavy Industries (Japan)

- CAF (Spain)

- Titagarh Rail Systems (India)

Collaboration, government contracts, localization, and R&D in autonomous systems are shaping competitive strategy.

Recent Industry Developments

2024–2025 Highlights

- Alstom (2024): Launched hydrogen Coradia iLint in Italy—first commercial hydrogen route in Europe.

- Siemens Mobility (2024): Deployed Mireo Plus B battery-electric trains in Bavaria after successful trials.

- Wabtec (2025): Completed a $120M automation project for autonomous mining trains in Chile.

- Hitachi Rail (2025): Began testing driverless operations on Tokyo’s Ginza Line with advanced obstacle detection.

Key Market Trends

🌱 1. Green Transition Accelerates

- Over 300 zero-emission trains expected in operation by 2025

- Hydrogen and battery trains gaining regulatory and financial support

- Global diesel phase-out initiatives reshaping future procurement

🤖 2. Digitalization & Automation

- Predictive maintenance platforms like Siemens’ Railigent

- Driverless metros boosting operational efficiency

- AI-led fleet optimization reducing maintenance downtime by up to 30%

Market Scope & Segmentation

Base Year: 2024

Forecast Period: 2025–2032

2024 Market Value: USD 42.38 Bn

2032 Forecast: USD 61.34 Bn

By Product

- Locomotive

- Rapid Transit Vehicles

- Wagons

- Others

By Type

- Diesel

- Electric

By Train Type

- Rail Freight

- Passenger Rail

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Conclusion

The Global Rolling Stock Market is entering a new era where sustainability, digital innovation, and infrastructure investment are redefining the rail landscape. While freight rail remains a foundational segment, the future lies in electric, hydrogen, autonomous, and smart rail technologies.

Countries prioritizing green mobility and modernization are expected to lead growth through 2032 as rolling stock becomes central to global transportation decarbonization.