The Transparent conductive films market size was valued at USD 6.75 billion in 2024 and projected to reach USD 11.60 billion by 2033, growing at a CAGR of ~6.20% 2025–2033.

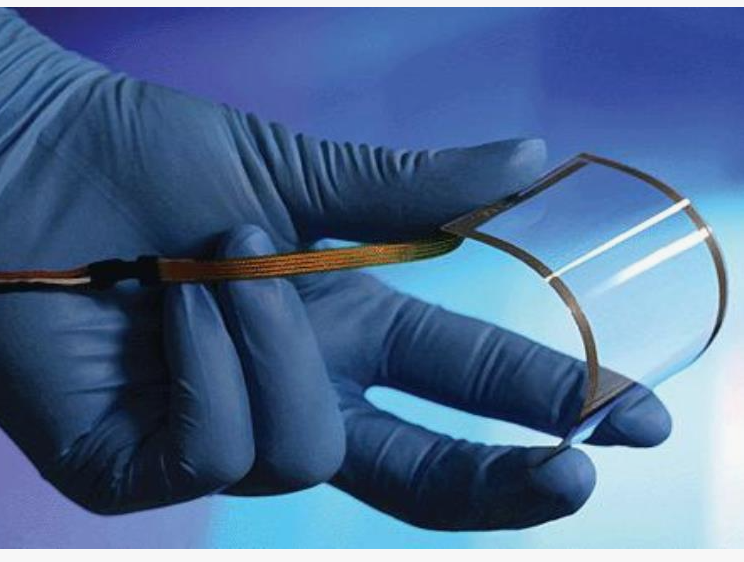

The Transparent conductive films market is growing mainly because of the surging demand for smartphones, tablets, and wearable devices, where TCFs are essential for touchscreens and displays. In addition, rising adoption of solar panels and energy-efficient technologies, along with the shift toward flexible and foldable electronics, is fueling growth. Ongoing technological advancements in alternative materials (like silver nanowires, graphene, and metal mesh) that overcome the brittleness and high cost of ITO are also driving market expansion.

Sample link:- https://www.datamintelligence.com/download-sample/transparent-conductive-film-market

Market Segmentation-

By Material / Technology

-ITO on Glass: This is traditional and commonly used because it has high optical transparency and conductivity. However, it is limited by brittleness and higher costs.

-ITO on PET: This option offers flexibility compared to glass-based ITO, making it suitable for lightweight and portable devices.

-Silver Nanowires: These are gaining popularity due to their excellent conductivity, high transparency, and suitability for flexible displays and wearable electronics.

-Metal Mesh: This material provides lower resistance and durability, making it useful for larger-area applications such as TVs and signage.

-Graphene: This is emerging as a next-generation option because of its superior flexibility, mechanical strength, and transparency. Nonetheless, scalability remains a challenge.

-Carbon Nanotubes (CNTs): Known for their excellent strength and conductivity, CNT films are being studied for advanced touchscreens and smart windows.

-Conductive Polymers (e.g., PEDOT): These offer low-cost manufacturing and work well with printing processes, making them ideal for mass production.

By Application

-Smartphones & Tablets: This category has the largest share, driven by the rapid adoption of touchscreen-enabled devices.

-Wearable Devices: This includes smartwatches, fitness trackers, and AR/VR devices; it is an emerging high-growth area.

-TV & Large Displays: TCFs are increasingly used in high-resolution OLED and LCD panels.

-Laptops & PCs: Demand in this area is stable but has been boosted by remote work and digital learning trends.

-OLED Lighting: Transparent electrodes support energy-efficient, ultra-thin, and flexible lighting solutions.

-Photovoltaics (Solar Cells): TCFs serve as transparent electrodes in solar panels, aiding the global clean energy transition.

Market Drivers-

-Rapid growth in consumer electronics :- The global uptake of smartphones, tablets, wearables, laptops, and touch-enabled devices is a prime driver. Transparent conductive films are integral in touchscreens and display stacks.

-Growing demand in photovoltaics / solar energy:- Transparent conductive films act as the front electrode (transparent conductive oxide) in many solar cell architectures. The push for renewable energy and solar installations increases demand.

-Emergence of flexible, foldable & wearable electronics:- Rigid ITO on glass is inadequate for bendable devices, so demand rises for flexible alternatives like silver nanowires, metal mesh, graphene, etc.

-Technological advancements & cost reductions:- Improvements in manufacturing methods (spray coating, roll-to-roll, inkjet printing) enable scaling of alternative materials, reducing costs and enhancing yield.

-Energy efficiency and sustainability trends:- As devices and infrastructure push for more energy efficient components, lower-loss transparent electrodes or higher performance films become more desirable.

Key Players-

-TDK Corporation

-TEIJIN Limited

-Cambrios

-Gunze Ltd

-C3Nano

-Canatu

-Dontech, Inc.

-Toyobo Co., Ltd.

-Nitto Denko Corporation

-XTPL

Recent Development in 2025-

-DuPont launches new silver nanowire TCF products (2025) :- In April 2025, DuPont introduced its Activegrid™ ink and Activegrid™ film, which use silver nanowire technology. This development highlights the move toward flexible and printable transparent electrodes.

-Advances in silver nanowire synthesis and processing :- A 2025 MDPI journal article discusses improved techniques for the synthesis, dispersion, junction welding, and mechanical strength of silver nanowire films. These improvements make them more suitable for commercial use.

-Novel room-temperature printing of conductive films using liquid metals :- Researchers created a method that uses liquid metals to apply ultra-thin metal oxide layers to surfaces at room temperature. This could lower costs, save energy, and simplify the process.

-New material investment trends :- As materials like graphene, CNTs, and hybrid composites become more popular, many companies are boosting research funding or forming partnerships to shift from rigid ITO to flexible technologies. (General trend from reports)

The rise of foldable smartphones, rollable displays, smart windows, and next-generation wearables is driving the demand for bendable, transparent conductors. Several display manufacturers are reportedly looking at non-ITO films for future devices (industry press).

-Scaling and pilot manufacturing :- Some companies are moving their pilot production lines from the lab to pre-commercial scale, especially for silver nanowire or metal mesh films. These efforts focus on improving yields, reducing defects, and enhancing consistency.

Benefits of the report:-

-Comprehensive Segmentation & Mapping:- The report visualizes segmentation by material, application, region, and other splits—helping users identify which submarkets are most attractive (e.g. silver nanowires vs ITO, smartphone vs solar).

-Trends & Opportunity Analysis:- It helps pinpoint emerging opportunities (e.g. flexible displays, wearables, non-ITO materials) and technology adoption curves.

-Competitive Intelligence & Benchmarking:- It profiles key players with strategies (product launches, collaborations, investments), enabling benchmarking and gap analysis.

-Data Tables & Models:- The report includes ~53 market data tables, ~51 figures, and ~180 pages, plus Excel data sheets for granular analysis.

-Decision Support for Investors / Manufacturers:- Users can assess market potential, ROI, entry strategies, risk evaluation, and Go/No-Go decisions for new technologies or geographies.

Conclusion-

The transparent conductive films market is set for steady growth, reaching over USD 11 billion by 2033, driven by rising demand in consumer electronics, solar energy, and flexible displays. While ITO still dominates, innovations in silver nanowires, graphene, and conductive polymers are reshaping the industry. Companies that invest in advanced materials and scalable manufacturing will be best positioned to capture the growing opportunities in this evolving market.