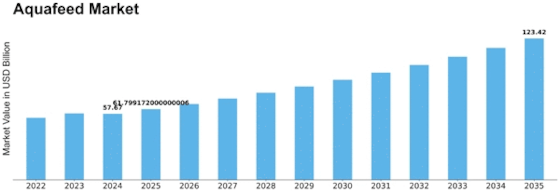

As the aquafeed market heads toward a projected USD 123.42 billion by 2035, according to MRFR, industry players face tremendous opportunities—and critical risks. Understanding both sides will be essential for strategic success.

On the opportunity side, one of the most compelling themes is scale. With aquaculture production continuing to rise globally, the need for formulated feed is growing rapidly. Feed companies that can scale efficient, high-performance products stand to capture significant Aquafeed market value. Moreover, the push toward sustainable ingredients—such as plant proteins and insect meals—offers long-term cost and environmental advantages, positioning forward-thinking producers for leadership.

Another opportunity lies in value innovation. Feed that enhances health (e.g., with functional additives) or supports precision nutrition can differentiate itself in a crowded market. Farms using these premium feeds may achieve better survival, faster growth, or reduced mortality—opening doors to higher-margin segments and premium pricing.

Infrastructure and regional growth also present windows of opportunity. MRFR identifies Asia-Pacific as the fastest-growing region for aquafeed, thanks to its massive aquaculture footprint and rising investments in sustainable farming. For feed producers, this means localized innovation—tailoring formulations for regional species, life cycles, and regulatory requirements.

However, these opportunities are not without risk. Scaling sustainable ingredients like plant-based proteins or insect meals requires investment, supply-chain development, and regulatory validation. Without proper partnerships and foresight, feed producers may face supply bottlenecks or cost overruns. Plus, switching to advanced formulations (such as functional or precision feeds) demands R&D investment and close alignment with farm practices.

Another risk lies in regulation. As sustainability becomes central, governments may tighten rules around ingredient sourcing, traceability, or environmental impact. Feed companies will need to stay agile and compliant—or risk losing market access or reputation.

Adoption risk is also real. Even if advanced feeds deliver value, persuading aquaculture producers to switch can be challenging. Farms may be conservative or operate on thin margins, making them wary of premium feed costs or uncertain ROI. Without strong demonstration of performance benefits, feed innovation could lag in the field.

Finally, competition is intensifying. Big players like Cargill, Nutreco, Skretting, BASF, Alltech, ADM, Mowi, Cermaq, Biomar, and Evonik are all investing in sustainable and high-tech aquafeed solutions. Smaller or newer companies must find ways to compete—either through niche specialization, agile R&D, or deep partnerships with farms and suppliers.

To navigate this landscape, feed producers and aquaculture stakeholders should adopt a balanced strategy: invest in R&D, secure sustainable ingredient supply chains, partner with farms for pilots, and build strong regulatory and certification capabilities. Those who do will be best positioned to harness the tremendous growth potential in the MRFR-forecasted aquafeed market.

But with opportunity comes challenge. Scaling up sustainable ingredient sources, ensuring consistent supply, and navigating regulatory landscapes are nontrivial. Innovation in feed is also capital-intensive. That said, early movers who can crack the code on cost-effective, high-performance, and sustainable aquafeed will likely dominate the market.

Looking ahead, the aquafeed market is not simply expanding—it’s transforming. The shift toward sustainable ingredients, technological precision, and functional nutrition is laying the foundation for the next generation of aquaculture. If the MRFR forecast comes true, feed suppliers and aquaculture companies who lean into innovation now will be best positioned to reap the rewards by 2035.