The Nitric Acid Market plays a central role in the global industrial and agricultural ecosystems, functioning as a foundational chemical in the production of fertilizers, explosives, dyes, polymers, and numerous organic and inorganic intermediates. The market's progression is closely aligned with agricultural expansion, industrialization trends, and the increasing global emphasis on high-efficiency fertilizer formulations. As countries accelerate their efforts to improve crop yield, support food security, and boost industrial output, nitric acid continues to gain relevance across diverse applications.

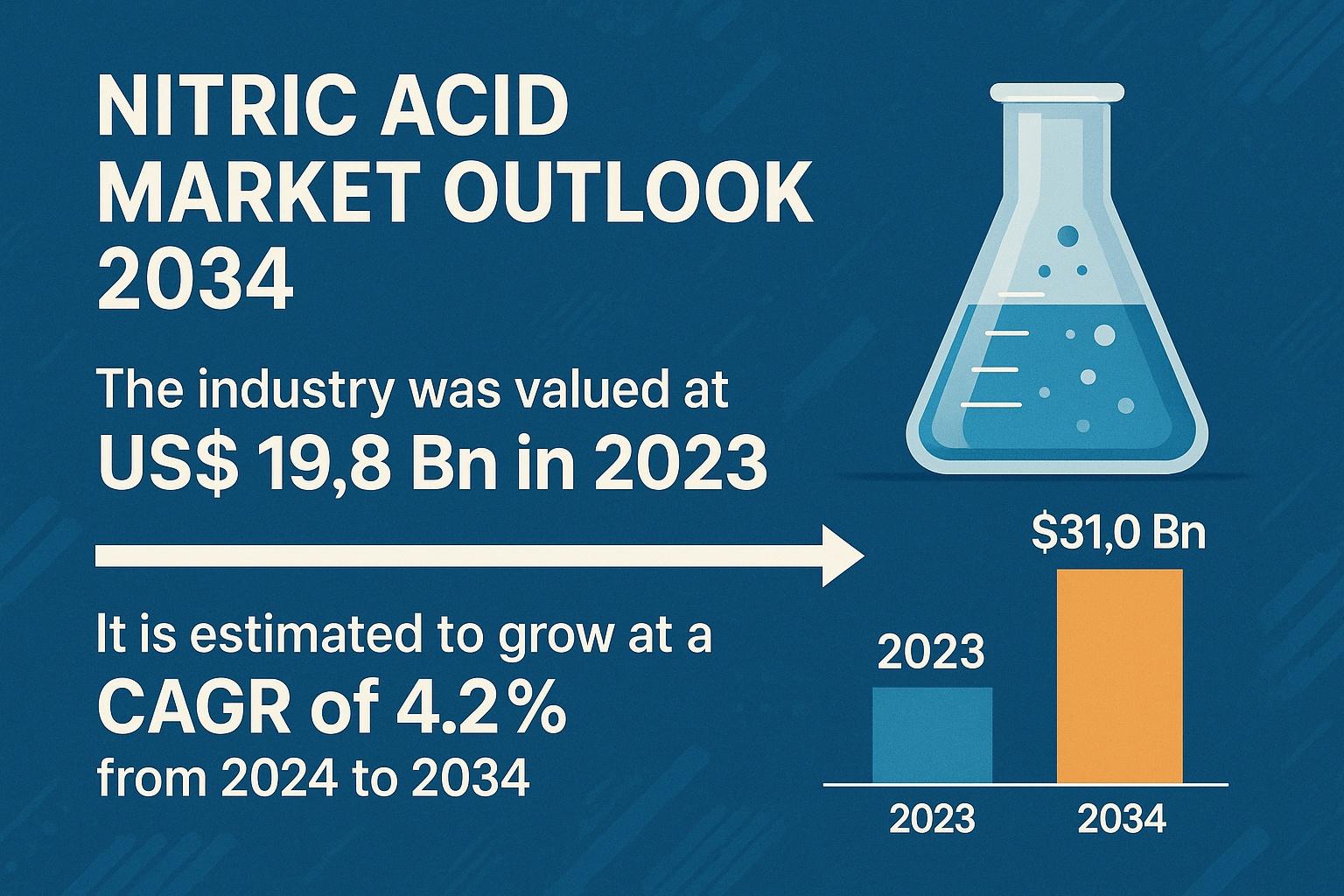

In 2023, the global market was valued at US$ 19.8 Bn. Supported by escalating fertilizer consumption, growing investments in chemical manufacturing, and advancements in sustainable production technologies, the nitric acid market is projected to expand at a CAGR of 4.2% from 2024 to 2034, ultimately reaching US$ 31.0 Bn by 2034. The sector is also influenced by trade dynamics, environmental regulations, capacity expansions, and the strategic realignment of chemical production among global regions.

Introduction to the Market Landscape

Nitric acid is one of the most essential industrial chemicals, serving as a precursor to ammonium nitrate and calcium ammonium nitrate—two of the most widely used nitrogen fertilizers in modern agriculture. Its influence extends beyond agriculture, touching industries such as aerospace, automotive, textiles, pharmaceuticals, and defense.

Historically, regions like Western Europe, North America, and Japan have served as dominant production bases due to advanced chemical industries and high technological expertise. However, shifts in production economics, energy costs, and demand centers have resulted in a structural rebalancing of the market, particularly toward Asia Pacific.

Chemically, nitric acid is indispensable in organic nitration, enabling the synthesis of compounds like nitrobenzene, dinitrotoluene, and other intermediates used in dyes, polymers, and explosives. It is also vital in the oxidation processes required for producing adipic acid, a critical input for nylon manufacturing.

Given its extensive downstream influence and strategic industrial importance, nitric acid remains a high-demand chemical with steady long-term consumption patterns.

Analyst Perspective on Market Evolution

From an analyst’s viewpoint, the nitric acid market is approaching a phase of stable, supply-driven transformation. Demand from the agricultural sector—particularly for nitrogen-based fertilizers—is expected to remain the single largest contributor to market revenue. The rising global population, combined with diminishing arable land, underscores the continued need for fertilizer solutions capable of improving soil performance and supporting higher agricultural productivity.

The sector is also witnessing robust investments in Concentrated Nitric Acid (CNA) and Weak Nitric Acid (WNA) capacity expansions. These upgrades aim to meet the rising demand from fertilizer plants, explosive manufacturers, and chemical intermediates producers. Moreover, the adoption of sustainable and emissions-reducing technologies is becoming a competitive differentiator among leading companies.

In this context, the nitric acid market is transitioning from a commodity-driven space to a more innovation-oriented industry, where efficiency, sustainability, and strategic regional production are shaping its next phase of development.

Market Drivers

1. Expanding Fertilizer Demand Supporting Market Stability

Nitric acid is a crucial component in the manufacture of ammonium nitrate-based fertilizers, which are extensively utilized to improve soil fertility and stimulate plant growth. The agricultural sector increasingly relies on nitrogen-rich fertilizers to address productivity gaps and meet rising food demand.

Key points supporting fertilizer-driven growth:

-

The FAO projects that food production must increase by 70% by 2050 to feed a global population expected to exceed 9 billion.

-

Nitrogen fertilizers remain indispensable in boosting crop yield, especially in countries with intensive agricultural practices.

-

Global fertilizer trade reached US$ 143 Bn in 2022, significantly higher than the US$ 97.4 Bn recorded in 2021, signaling rising global fertilizer circulation.

Major exporting nations—including Russia, Canada, China, the U.S., and Morocco—depend heavily on nitric acid as a raw material. Thus, fertilizer demand remains firmly tied to the long-term growth trajectory of the nitric acid market.

2. Rising Investments in Concentrated Nitric Acid (CNA) Production

A prominent trend is the increasing investment in CNA production facilities. CNA is a critical raw material for explosives and fertilizers, and many companies are actively scaling their production capabilities.

Examples include:

-

GNFC (Gujarat Narmada Valley Fertilizers & Chemicals Ltd.), which expanded its CNA capacity to approximately 165,000 MT by 2022 through the installation of a fourth production unit.

-

Casale’s partnership with Agropolychim in 2023, aimed at doubling nitrogen-based fertilizer production capacity using advanced dual-pressure nitric acid technology.

These investments illustrate a global shift toward decentralizing and strengthening nitric acid production, ensuring reliable feedstock supply for downstream industrial and agricultural uses.

3. Technological Innovation and Environmental Compliance

Nitric acid production is energy-intensive and generates significant greenhouse gas emissions—particularly nitrous oxide (N₂O), a potent climate pollutant. In response, chemical producers are increasingly installing N₂O abatement systems, investing in low-emission technologies, and adopting water recycling processes.

For example:

-

KBR Inc.'s MAGNAC CNA technology, deployed by GNFC in 2023, enhances plant efficiency while reducing environmental impact through innovative water recycling and low-emission solutions.

Sustainability-driven innovations are likely to accelerate as more countries tighten regulations governing industrial emissions, energy consumption, and waste management.

Market Trends

1. Shift of Production to Cost-Competitive Regions

Due to increasing energy costs and stricter environmental regulations in Europe, nitric acid production is gradually migrating toward energy-efficient and resource-abundant regions—primarily Asia Pacific.

The region is becoming a global manufacturing hub due to:

-

Affordable labor

-

Lower energy costs

-

Growing domestic fertilizer demand

-

Government incentives for chemical manufacturing

As a result, countries like India are attracting substantial foreign investment from European companies seeking cost-effective production alternatives.

2. Increasing Use of Nitric Acid in Specialty and High-Value Applications

Beyond fertilizers and explosives, nitric acid is used in industries such as:

-

Automotive, for metal finishing

-

Electronics, for high-purity etching chemicals

-

Plastics, for adipic acid production

-

Defense, for the synthesis of energetic compounds

This diversification enhances market resilience and opens new growth pathways.

3. Growing Global Trade Dynamics

With South Korea and Europe accounting for over 80% of nitric acid exports, the market remains globally interconnected. However, recent supply fluctuations, especially in Europe, have increased reliance on Asian suppliers.

This shift reinforces Asia Pacific as a key consumption and supply corridor for nitric acid and related intermediates.

Regional Analysis

Asia Pacific – Dominant Market with Expanding Influence

Asia Pacific is the largest nitric acid market and is projected to retain its leadership through 2034 due to:

-

Rapid agricultural industrialization

-

Expansion of fertilizer production plants

-

Growing investments in CNA and WNA facilities

-

Favorable government policies encouraging chemical manufacturing

India, China, South Korea, and ASEAN countries contribute significantly to regional demand and export volumes. Europe's reduced production activity has further strengthened Asia Pacific’s role as the global center for nitric acid production and distribution.

Europe

Europe remains a mature nitric acid market with advanced production technologies and strong demand in chemicals and specialty manufacturing. However, high energy costs and stringent environmental regulations have challenged industrial output. The region is increasingly focusing on green nitric acid processes and low-emission manufacturing.

North America

The U.S. is a significant consumer of nitric acid, driven by fertilizer demand in major agricultural regions and the presence of several large-scale industrial manufacturers. Technological innovation and efficient supply chains support stable market growth.

Latin America and Middle East & Africa

-

Latin America—particularly Brazil—is witnessing strong fertilizer consumption due to expanding agricultural acreage.

-

MEA is emerging as a growing market as nations like Saudi Arabia invest heavily in petrochemicals, explosives manufacturing, and fertilizer production.

Competitive Landscape

The nitric acid market is moderately consolidated, with global players leveraging technological innovation and capacity enhancement strategies to strengthen their market positions.

Key Market Players

-

BASF SE

-

The Chemours Company

-

Eurochem Group

-

Dyno Nobel

-

Nutrien Ltd.

-

Sumitomo Chemical Co., Ltd.

-

Yara

-

CF Industries

-

Deepak Fertilisers and Petrochemicals Corporation Limited

-

OCI

These companies place strong emphasis on:

-

Operational efficiency

-

Clean technology adoption

-

Product portfolio expansion

-

Strategic partnerships and plant upgrades

Notable Developments

-

January 2024: SCCH and Dyno Nobel signed an MoU to build a major nitric acid and ammonium nitrate production facility in Ras Al Khair, with an annual nitric acid capacity of 440,000 tons.

-

August 2023: DFPCL announced a major nitric acid expansion initiative at Dahej, featuring a 300 KTPA WNA plant and 150 KTPA CNA capacity, strengthening India’s position in the global supply network.

Market Segmentation Overview

By Application

-

Fertilizers

-

Nitrobenzene

-

Toluene Diisocyanate (TDI)

-

Adipic Acid

-

Metal Processing

-

Others

By Region

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Key Countries

U.S., Canada, Germany, U.K., France, Italy, China, India, Japan, ASEAN, Brazil, Mexico, GCC, South Africa

Market Snapshot

| Attribute | Details |

|---|---|

| Market Size (2023) | US$ 19.8 Bn |

| Market Forecast (2034) | US$ 31.0 Bn |

| CAGR (2024–2034) | 4.2% |

| Historical Data | 2020–2022 |

| Market Coverage | Value (US$ Bn), Regional & Segment Analysis, Trends, Drivers, Competitive Overview |

The market assessment includes Porter’s Five Forces, value chain analysis, qualitative insights, and competitive benchmarking.

Conclusion

The nitric acid market is undergoing a transformative phase marked by expanding fertilizer demand, rising capacity investments, technological modernization, and a regional shift toward Asia Pacific’s cost-competitive industrial environment. With strong growth prospects and increasing adoption of sustainable technologies, the industry is positioned to deliver steady long-term performance through 2034.